【#BusinessManagement #PolicyDesign】#RnR #Overdue #AR

and #CreditLimit #Approver 202305010001

Hi. This is Emily from Taiwan, finance and accounting work background, the author of Whatsyouridea1996 blog.

Thank you for your

interest in my articles; please also go to click above [PolicyDesign] tag or

download this blog’s category and filter, choose and click

to view related articles.

Emily Says:If you

define the work roles and responsibilities properly and complete the definition

works, you almost complete the management policies and work processes design!

This article

related to policies design for work

owners departments of Accounts

Receivable Collection and Customers’

Credit Limit Approver at companies in retailing and service, trading or

general manufacturing industries etc. These are majorly for dealers or agents

or business model related to B2B; all the paragraphs are listed below, please choose your most interest topics or

their colors and jump to the section to view:

1. Story sharing: To recognize the bad debt, to successfully collect the

account receivable?!

2. What’s your idea:

(1) [Role and responsibility] discussion takes the most time in policies

design.

(2) To cut from top to bottom, balance the role and responsibility, simplify

the things; decision made won't always

follow this rule.

3. Who makes money, who collects money and who urges to pay: To exchange

[products or service] for customers' [money].

Before viewing the article, please listen to this recommended song: Jay Chou【Far Away (feat. Fei Yu-ching)】

https://www.youtube.com/watch?v=ocDo3ySyHSI&list=RDocDo3ySyHSI&start_radio=1

1. Story sharing: To

recognize the bad debt, to successfully collect the account receivable?!

When I worked for

Company A as an [Accounting Manager], firstly, my work mission was to

[reorganize the accounting records], it included many overdue accounts

receivables and the amount was significant(I say “significant” because the

number was bigger than my salary😆 ),

there was also temporary records generated from system posting; payers of those

account receivables included Banks,

and the collection work owner

was [Treasury Department](we

both reporting to CFO), and, regarding the Bank receivable, it refused to pay

because they felt the contents in our payment request documents were incomplete

or flaw. I forgot the detail of the flaw, I remembered the overall situation

was our company thought the problems were in Bank side, though, the company has

never taken legal action before my handling this case and it has not recognized

the bad debt, either; I felt something weird; on the other hand, my colleague

told me, there were senior managers of other departments would like to know [in

the past, the former mighty Accounting

Manager cannot achieve the mission of clearing accounts or closing the accounts

reorganizing project, what would this

new comer Emily do for that?!] (👈What?! What kind of attitude is this?! 😆 )

💡! “Everybody please formalize and documentize

your opinion as supporting evidence for further discussion in the future!”=>

I raised this request, and then…….the Bank paid us! It was the amount they

needed to pay! 😃

I’ve prepared for

the worst and would like to gather all related information for my “formal

report” to my CFO and CEO, furthermore, this report was for my supporting

documents for “tax and legal purpose” in the future once there is further work

instruction, they all need formal

documents from Bank side. Hence, I asked for help from our Treasury

Department for that “formal response

from Bank”, and it needed to have “corporate

seal and stamped in red(*) on it”.ç I though the Bank

would be happy to do that, right?!

(*)In Taiwan, to

stamp in red, usually, it means it’s formal, and those in blue

are more general.

Moreover, I hope could know how the Bank would formally describe the reason they “refuse” to pay? I hope the opinion was not from their staff members but the person who is able to represent for them formally! …Unexpectedly, they paid, I was shocked! 😄

Though, I guessed there was

something unusual in the whole work procedures in the past, I didn’t plan to

find it out since I’ve completed my work mission then.

I hope this story

has brought you some inspiration.😊

2. What’s your idea:

(1) [Role and responsibility] discussion takes the most time in policies

design.

(2) To cut from top to bottom, balance the role and responsibility, simplify

the things; decision made won't always

follow this rule.

(1) [Role and responsibility] discussion takes the

most time in policies design.: Do you agree with this?!

I think it this way and have never changed, and I sincerely invite you to share

your opinion. It’s just like the advice in [#BusinessManagement] Selecting Consultants is likeSelecting Talents, if you would like to hire external

consultants for your policies development someday, I suggest you to prepare

questions related to work role and responsibility issues to ask for candidates’

opinion as one of your screening requirements.

(2) To cut from top to bottom, balance

the role and responsibility, simplify the things; decision made won't always follow

this rule: Usually, when people are talking about work role

and responsibility, only “parties

involved” are considered and they are discussed their appropriateness,

there is nothing bad in this, however, to the end, we need to consider [management

responsibility] and [internal control issues], I suggest the discussion could focus

on “It belongs to which CXO(VP of OOO) is more appropriate?!” for decision

making in order to clarify the issues and make things done easier. CXO work

position is the head of work function, the highest work position, it won’t change once the person in tihs

role changes: Chief Financial

Officer, Chief Legal Officer,

Chief Sales Officer and Chief

Marketing Officer….

For example: In

some events, in the beginning, the roles and responsibilities discussion

involved departments of Product, Procurement, Accounting, Treasury, Sales and

Risk etc., and I suggest people to adjust their focus, they should discuss the

roles and responsibilities among Chief Marketing Officer ( or Chief Products

Officer), Chief Procurement Officer, Chief Financial Officer, Chief Accounting

Officer, Chief Sales Officer or Chief Risk Officer, this makes things look

clearer because it brings another

kind of viewpoints. So, I suggest you to define the work roles and

responsibilities among CXO

before authorizing/allocating/discussing the departments below them (Chief Financial Officer->Treasury

Department;Chief Sales

Officer ->Sales Department…).

EX1:Is Chief

Sales Officer or Chief Financial Officer the work owner of

collecting Accounts Receivables?!

Because ______________.

EX2:Is Chief

Sales Officer, or Chief Financial Officer or Chief Risk Officer

the work owner of collecting overdue Accounts Receivables?!

Because

______________.

EX3:Which is

more appropriate to do customer credit limit [request for approval]? Team

members of Chief Sales Officer or Chief Financial Officer or Chief

Risk Officer?!

Because ______________.

EX4: [To

verify and investigate] customers credit, it is more appropriate to be

conducted by team members of Chief Sales Officer or Chief Financial

Officer or Chief Risk Officer?!

Because

______________.

EX5:In the

result of above 4, it is the Chief Financial Officer or Chief Risk Officer’s

job to [define] the level of customers’ credit risk?!

Because

______________.

EX6:Because

of above 3~5, it is more appropriate to [define] customers’ payment terms by Chief

Sales Officer or Chief Financial Officer or Chief Risk Officer?!

Because

______________.

EX7:Because

of above 3~6 and to follow all defined rules above, it is more appropriate to

[approve] above customers’ credit limit request by

Chief Sales Officer or Chief Financial Officer or Chief Risk

Officer?!

Because

______________.

What are your

answers?

Decision made won't always follow this rule:It means => [the

decision boss would like to make may not be in alignment with specific logic

and internal control!].

EX1:Auditing

department needs to be independent and report to the Board directly, however,

practically in Taiwan, there are companies define Auditing needs to report to

Finance and Accounting, Legal or President Office because of many kinds of reasons.

EX2:There is a producing by order company, in the beginning,

they defined non-sales departments, including inventory storage management,

belong to the management field of Chief

Financial Officer; later, they changed themselves to become a business work

performance oriented company, they adjusted the inventory storage management as

a department under Chief Sales

Officer; hereafter, the Chief

Sales Officer is not only responsible for sales achieving rate but also

those would influence sales performance, such as plant producing capacity,

products quality, storage spaces and plant security etc. everything related to

goods needs to be in his work management field. The company thinks Chief Financial Officer can also

monitor business work performance via number generated for finance statements

and make it more concise, the volume of Chief Financial Officer’s work did not

decrease.

What’s your comment about this work arrangement?!

For your reference: Due to its industry

characteristic, because its Procurement Department work responsibility involves

vendors supplying quality assessment, I suggest they need to separate their Procurement

Department from Sales and Products Department in order to early control or

reject high flaw rate or high slow

moving products re-purchasing request, and to avoid any improper work instruction from Sales and Products

Department, so, they don’t need to wait for improper purchasing goods received

and to review it via finance number. Thus, to properly arrange work

role and responsibility can enhance management work efficiency before flaw happens;

to monitor finance number for business management is not always the best way

for Chief Financial Officer to contribute their work value, it needs to

consider and ensure the number is generated independently without any

manipulation.

3. Who makes money, who collects money and who urges to pay: To exchange [products

or service] for customers' [money].

The picture above shows the result of my survey via LinkedIn at 2023/4: the work owner of overdue Account Receivable collection, due date is 1/31 and has not received on 4/8?! There were 970 viewers within two weeks; however, only 10 placed the vote. And, it means, in this voting, Finance and Accounting, Legal and Sales vote percentage is not 0%, obviously, opinion won’t be the same though the involved people are not many. Do you agree with this idea?! Regarding work role and responsibility discussion in some companies, they [love to see] everyone thinks differently, so they are able to see things in various aspects and hope could find an answer to meet all needs, this situation is similar to Q&A meeting mentioned in a chart in How to 【write/build】 policies ?:it needs to be fully discussed…;do you agree?!

(Below also utilize

job title of work function head to discuss work role and responsibility

issues.)

Responsible for making money: is the work duty of Chief Sales Officer, less people would doubt

about this.

Collection work owner:Account receivable is the result of

exchanging products or service (assets of the companies) with customers for

money not paid immediately; it is Chief Sales Officer exchanging

products or service with customers, thus, Chief Sales Officer needs to

get the money back from customers to the companies, otherwise, Chief Sales

Officer has the rights to provide products or service to customers but has

no responsibility to collect the money back, this causes its work role and

responsibility not balanced. Do you agree?!

Work owner of overdue account receivables collection: If this work

responsibility belongs to someone else rather than Chief Sales Officer as

above, then, this person should be the one to do collection in the beginning once

account receivables is generated, right?! The company doesn’t need to wait for

its overdue then change the person to collect it back! 😌

Yes, you can say “overdue account receivables collection work owner” is a

trick question.

The issue is “who should start the overdue

receivables collection work procedures?” and “how to do it?”

Discussion: If the company needs to start the overdue receivables collecting work procedures once the Chief Sales Officer cannot achieve the work before the deadline, then, how to manage and ensure the Chief Sales Officer would surely kick off the work rather than to ignore it on the contrary?!

Advised tool: Account

Receivables Aging Reports by Chief Accounting Officer +periodically

follow up Account Receivables

clearing/wash-up/offset sheet(note1) well prepared and sent back from Chief

Sales Officer.

(note1) Account Receivables clearing/wash-up/offset sheet:Chief Sales

Officer needs to prepare one of below kinds

of documents according to actual collection progress, fill it up and send back to Chief Accounting Officer

as the supporting documents for account receivables accounting records

adjustment:

(1)[Customers Paid Notice with

signatures or received stamp of Chief Sales Officer and Chief

Financial Officer]+[account

receivable statement].

(2)[Notice of Kicking-Off Legal

Action for Receivables Collection with signatures or stamp of Chief

Sales Officer and Chief Legal Officer](or collection reports or request

for approval…..in form of explanation.)

(3)[Bad Debt Report with

signatures or stamp of Chief Sales Officer and Chief Legal Officer]+other

legal documents

EXP1:You don’t need to prepare any kinds of written documents if all above work

process are systemized.

EXP2: Before Notice

of Kicking-Off Legal Action for Receivables Collection procedure, there are

lots of required oral communication; however, Chief Accounting Officer needs to take the initiative to check the accounts record directly

with customers and also needs to acknowledge Chief Sales Officer before taking this

action, be ready to provide account receivables record for Chief Legal

Officer and Chief Sales Officer in order to proactively conduct internal control and manage accounting records’

freshness to timely reflect accounting information close to the truth

on time to reach departmental work mission.

EXP3: After receiving the legal action kicking-off

notice, the Chief Legal Officer needs to take related action to collect

the receivables accordingly.

EXP4: In the overall

situation, to describe it in internal control term, Chief Sales Officer

is the account receivables collection Project Manager, and, the Chief

Accounting Officer has the responsibility to monitor this project works goes

on time by progresses, all involved work departments need to “sign” on related

documents to express “information well received” or “ got it” or “approved”.

Chief Accounting Officer has no

opportunity to ignore their own monitoring work responsibility and take the

initiative, it is because they need to periodically explain and report the

accounting information to CEO and/or Board of Directors; however, there is an exception…no one knows

how to utilize accounting information or no one knows the required

accounting reporting procedures. Practically, all kinds of situations are

happening frequently.

Above all, all the

work departments are responsible for their own work progress and keep others

informed about the most updated situation. If the information is updated via

email, it is advised to use this format:

From: email sender***

To: Sales

Department(account

receivables collection project manager)

Cc: Another

involved department

Subject:[sender department***report]OOO customer’s

account receivable collecting work progress

Hence: Account receivables collection work owner is Sales

Department, the work owner to become another department is because the company

needs to adjust the way to collect it back, so, it extends to Accounting and

Legal Department and hope could get it back as soon as possible; if we/Sales

Department request for help from others to collect receivables, it doesn’t mean

we have no responsibility for those things we are asking for help. Then,

Sales Department is the overall work

PM of this collection work. Do you agree?!

If the company has built up a policy for work compliance, it doesn’t mean

oral communication is not allowed or not required before policies compliance work.

All complete oral communication needs to be done before documentation or system

works for making consensus first.

4. Does customers’

credit limit approval [right owners] need to take the [responsibility] for not

enough customers, sales not achieved or bad debts?

This question also attracted more than 1,000 views within 2 weeks, however, there were only 17 votes;why?! I hope I will get the answer someday.😒

Accounting got 0

vote, I also think the same, so, I won’t include Accounting into below

discussion; should you have question, please click to contribute an article as an management work

professional or leave message below or use above Contact Emily at the right

hand side and submit message to me. Thank you.

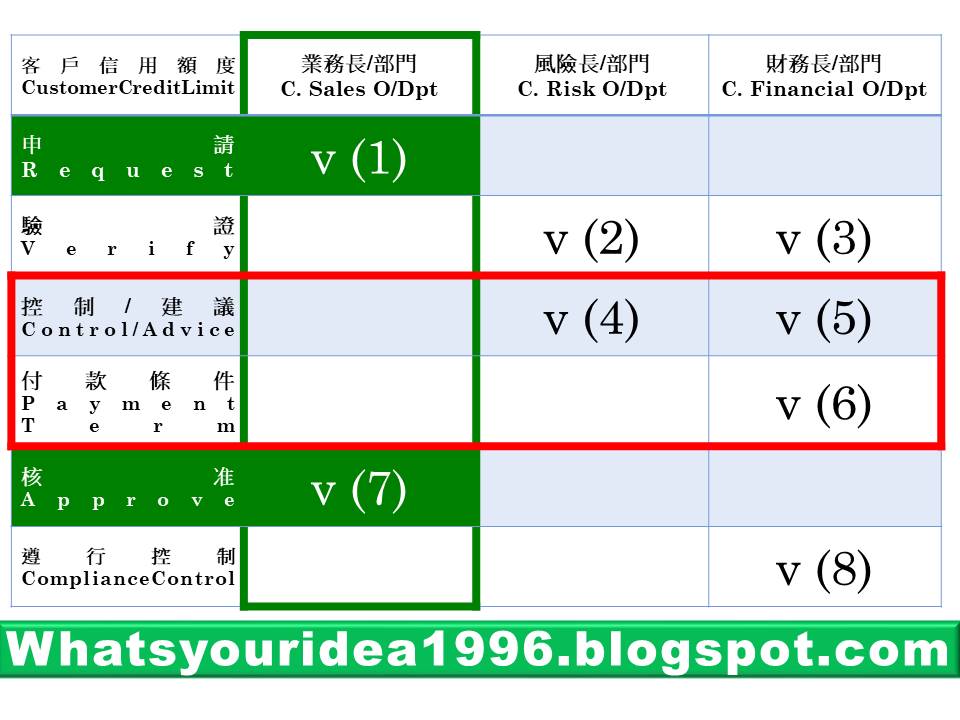

If we also discuss by [work functions] and their [department heads’ job

titles], who should be customer credit limit approver? Chief Risk Officer, Chief Financial

Officer or Chief Sales Officer?!

If we go back to above 7 questions in pink, what your answers will be?!

My advices are:

EXP1:The company

needs to take all the departments as the same work level, no one is higher than

others, thus, approval request cannot be approved

by another work department, then, customer credit limit approval

requester(1) and approver(7) need to be the

same work department.

EXP2: Verify = (2)

and (3) in above chart, it means credit checking. Except for leasing companies

or sizable companies, they separate Risk Department from other work units,

however, we usually find that companies usually define Chief Risk Officer/Risk

Department and Chief Financial Officer/Finance Department are the same work

department, they do customers’ credit verification by going through customers

profiles and those information provided by Chief Sales Officer/ Department and

check and verify the credit records via Banks or Credit Checking work

organization in the scope authorized by customers.

EXP3:Control and

Advice=(4) and (5) in above chart, it means, the companies assess customers’

credit limit amount appropriateness by following their own predefine customers’

risk level and the ways of risk avoidance. E.g. After risk assessment, the

result of a specific customer’s risk level is N=Not suitable to define credit

at this moment, or H=High Risk, and, some will be advised to increase the value of customers’ collaterals, and this

would also cause impact on (6), (6)=this

customer needs to 100% pay in advance.

EXP4:Payment Terms, (6) in above chart belongs to Chief Financial Officer’s management

scope, others need to follow its rule, so, after this, the request needs to go

to (7), the requester department follows all above work procedures and to

re-assess their request amount and consider they need to ask for customer’s

collaterals increase or not, otherwise, they need to consider to adjust their

requested credit limit amount, more than that, they also need to rearrange

their customers’ sales contribution plan, to make a conclusion and approve

accordingly, furthermore, they need to input the approved customer profile

and credit limit amount into system.

EXP5: Regarding (8) in the chart

above, it is Chief Financial Officer/Finance Department to conduct compliance control, we usually

say it is to “activate/take effect” the new customer’s profile information or “release”

the blocked exceeded credit limit sales order, it needs to be separated from

Sales Department.

EXP6: There are some other reasons

to define Chief Sales Officer/Department as the customers’ credit limit

approver:

- It is Sales

Department daily routine work

activities and role and responsibility to physically

observe customers’ business operation, business reputation in the industry for

credit limit assessment.

- Sales achievement

amount relies on customers’ credit limit amount, if the credit limit amount is

lower that causing sales amount not achieved, then, Sales Department needs to

create another sales or they need to do another customer development and to consider

how many customer order they need to create, Sales Department needs to consider

the pros and cons before their final request approval.

EXP7: There are

also companies define their credit limit approver work owner as Chief Financial

Officer/Finance Department, that is, (7) in above chart belongs to Finance

Department, and, in this situation, Chief Sales Officer/Sales Department only

needs to do request while the Finance Department has the right to

reject(=not approved) and Chief Financial Officer/Finance Department doesn’t

need to be responsible for sales achievement, it causes both departments work

roles and responsibilities not balanced and sales achievement may grow more

slowly or causes work conflict cross functionally.

EX1: Chief Sales Officer/Sales Department: sales amount not achieved is

because the approved customer credit limit amount approved by our Chief

Financial Officer is always smaller than requested, thus, do we need to split

the sales orders?!

EX2: Chief Sales Officer/Sales Department: I have no responsibility about

the bad debt, I am responsible for sales achievement only.

What’s your idea?!

Please share your idea.

This is Emily, I hope this article is helpful to you:

Please sponsor by the level you feel helped:

-

Only a little:Sponsor Emily hot green tea TWD111 X n cup.

-

General:Sponsor Emily to create other article(s) TWD1,111 X n post.

-

Crystal clear:Sponsor Emily TWD11,111 or above and get the opportunity to advertise for free.

-

Feel"Ah-ha!

That is what it is"💡:Sponsor Emily TWD111,111 or above and get larger space to

advertise.

-

Any

amount you prefer.

Sponsor payment tool and explanation. 👈

Sponsor and advertise:Return for Kindness 👈

Sponsors please leave message:Brands Wall 👈

-

Please follow me via LinkedIn, LIKE👍 and switch on

its notification bell at its upper

right side🔔.

- Download blog category and filtering to view, forward to 3 persons in need:

-

Click to view

news via 【Attention Please】!

- Join Self Media to promote yourself for free: to share professional knowledge, caring stories or recommend a book and advertise for free accordingly.

Wishing you good health, peace and happiness and abundance.

Thank

you for open resources

#Pinterest, #PixLr, #Illustrations,

#Pixabay, #Google, #YouTube, #Blogger, #Meta, #Line, #FollowIt, #LinkedIn,

#KissCC0,#Skype ,

#SwashyFont

#whatsyouridea #businessmanagement #career #internalcontrol #policydesign #creditlimit #accountreceivable

#risk #creditrisk #whatsyouridea1996 #ar #arcollection #roleandresponsibility